Latest

Features , Guest Blog , Long Reads

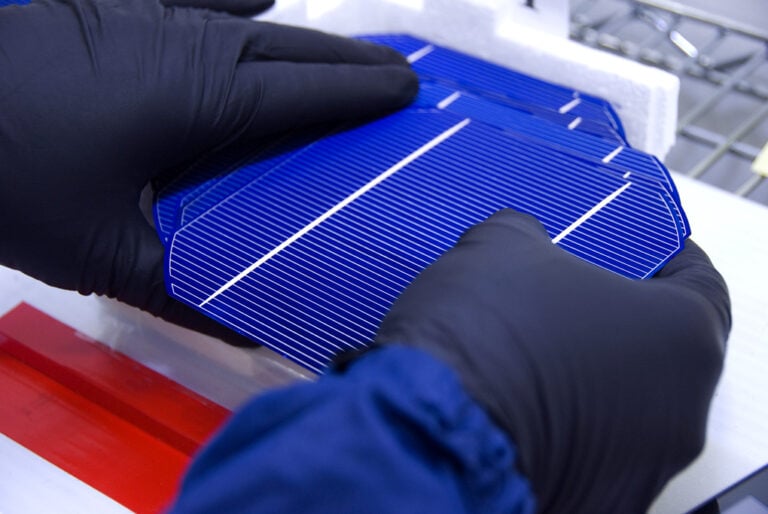

The site is expected to be operational by the end of October and commercially producing wafers in “early 2026”. Image: Smallman12q/Wikimedia Commons

Korean chemical production firm OCI Holdings has acquired a 65% stake in a Vietnamese solar wafer production plant, intending to export solar wafers to the US.

Today, the company announced that its subsidiary OCI TerraSus has established a Singapore-based special purpose vehicle (SPV) to acquire a 65% stake in a 2.7GW wafer production facility in Vietnam. The site is currently under construction by Elite Solar Power Wafer Co. Ltd.

This article requires Premium Subscription Basic (FREE) Subscription

Already a subscriber? Sign In

Try Premium for just $1

Full premium access for the first month at only $1

Converts to an annual rate after 30 days unless cancelled

Cancel anytime during the trial period

Premium Benefits

Expert industry analysis and interviews

Digital access to PV Tech Power journal

Exclusive event discounts

Or continue reading this article for free

The SPV, named OCI ONE, invested around US$78 million in the site, which the company said is worth a total of US$120 million.

The site is expected to be operational by the end of October and commercially producing wafers in “early 2026”. OCI said the site could be expanded to double its capacity, to 5.4GW, with a further US$40 million investment within six months.

The company is specifically targeting shipments to the US, where the Trump administration has imposed strict Foreign Entity of Concern (FEOC) and Prohibited Foreign Entity (PFE) restrictions on renewable energy supply chains. These affect Chinese imports and products with significant Chinese financial backing, which comprises the overwhelming majority of polysilicon-based solar products.

“This strategic investment brings us closer to building a supply chain that facilitates US exports,” said Woo Hyun Lee, chairman of OCI Holdings. “We will continue to strengthen our presence in the global solar market by fostering partnerships with local companies in Southeast Asia.”

OCI Holdings has its own polysilicon production capacity, via OCI TerraSus, in Malaysia, which it will use to produce wafers in Vietnam.

The company is currently building a US solar cell manufacturing facility in Texas via its subsidiary, Mission Solar. The US$265 million plant is expected to begin production in the first half of 2026.

Though unconfirmed, it is likely that the Vietnamese non-FEOC wafers would be shipped to Mission Solar for cell production in 2026. PV Tech has contacted OCI Holdings for details of its US shipment plans.

OCI is already in a polysilicon supply deal with fellow Korean-backed solar manufacturer, Hanwha Qcells, in the US. In May, polysilicon market analyst Bernreuter Research reported that OCI had returned to profitability after low prices and overcapacity in China had hit the entire global polysilicon market. This is despite OCI Holdings’ decision to delay its Malaysian IPO in April after macroeconomic uncertainty following president Trump’s global tariff regime.

Returning for its 12th edition, Solar and Storage Finance USA Summit remains the annual event where decision-makers at the forefront of solar and storage projects across the United States and capital converge. Featuring the most active solar and storage transactors, join us for a packed two-days of deal-making, learning and networking.

PV Tech has been running PV ModuleTech Conferences since 2017. PV ModuleTech USA, on 16-17 June 2026, will be our fifth PV ModulelTech conference dedicated to the U.S. utility scale solar sector. The event will gather the key stakeholders from solar developers, solar asset owners and investors, PV manufacturing, policy-making and and all interested downstream channels and third-party entities. The goal is simple: to map out the PV module supply channels to the U.S. out to 2027 and beyond.

Read Next

France’s Engie and the UAE’s Masdar have been chosen to jointly develop a 1.5GW PV power plant near Abu Dhabi.

Brett Beattie of Castillo Engineering looks at some of the key land grading work that can make multimillion-dollar differences to projects.

The Trump administration has cancelled the 6.2GW Esmeralda 7 solar project in Nevada – once touted as one of the largest in the world.

Two Chinese state-owned energy enterprises have signed cooperation agreements on PV and wind power projects with Saudi companies, with the total contract value exceeding RMB30 billion (US$4.2 billion).

ANSI has approved a new traceability standard proposed by the SEIA to improve transparency of the solar and storage supply chain.

US solar manufacturer T1 Energy has acquired a minority stake in fellow US-based solar cell producer Talon PV.

Subscribe to Newsletter

Most Read

Upcoming Events

PV Tech is part of the Informa Markets Division of Informa PLC

This site is operated by a business or businesses owned by Informa PLC and all copyright resides with them. Informa PLC’s registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Copyright © 2025. All rights reserved. Informa Markets, a trading division of Informa PLC.

https://www.pv-tech.org/oci-holdings-eyeing-us-market-with-65-stake-in-2-7gw-vietnamese-solar-wafer-plant/